You’ve heard it a million events, nevertheless I’ll say it as soon as extra. It pays to purchase spherical in your mortgage.

Freddie Mac knowledgeable us a while once more, and now the Consumer Financial Security Bureau (CFPB) has echoed the an identical.

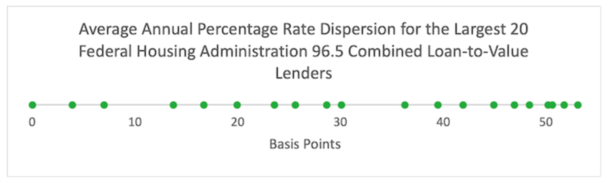

And it’s not a trivial amount of economic financial savings. The bureau found that value dispersion for mortgages is usually 50 basis components (.50%) of the APR.

When a median mortgage amount of about $300,000, we’re talking a distinction of roughly $100 month-to-month.

That’s $1,200 yearly in extra costs (or monetary financial savings) and $6,000 through the first 5 years of the mortgage time interval.

Mortgage Lenders Present the Comparable Precise Merchandise at Completely totally different Prices

Very like practically each different enterprise, mortgage lenders present the an identical merchandise for numerous prices.

Residence loans aside, plenty of corporations promote the exact same product. That’s why there are comparability websites or Google shopping for.

You enter a product and in addition you’re supplied with various prices, supply costs, and so forth.

Throw in a coupon code or pricing explicit and one agency may presumably be offering pretty the bargain relative to the remaining.

Whereas mortgages are a bit further distinctive, as you’re working with a workforce of individuals to close your mortgage, the underlying product is often the an identical, a 30-year mounted mortgage.

Most dwelling shoppers and even current house owners who refinance choose a 30-year fixed-rate mortgage.

This means you’re getting the an identical product irrespective of the place you get it from. The excellence is the service and possibly the competency of the company or explicit particular person to essentially fund the issue!

Nonetheless assuming we’re evaluating two competent lenders (or mortgage brokers), you wind up with exactly the an identical issue.

As such, you shouldn’t pay further for it. And to stay away from paying further for it, it’s greatest to place inside the time to purchase mortgage costs AND costs.

Pricing Can Vary Considerably All through All Mortgage Varieties

The CFPB carried out an evaluation to seek out out the magnitude of value dispersion amongst dwelling loans.

They did this by combing through Residence Mortgage Disclosure Act (HMDA) info from 2021.

And they also found that prices assorted “in practically every part of the mortgage market.”

This incorporates conforming loans backed by Fannie Mae and Freddie Mac, jumbo loans, and government-backed selections, akin to FHA loans and VA loans.

As well-known, this value dispersion for mortgages sometimes hovers spherical 50 basis components (0.50%) of the annual proportion cost (APR).

As an illustration, all through 2021 the median fee of curiosity was 3% (positive, all of us miss today!).

Nonetheless not all people obtained a 3% mortgage cost. Many house owners obtained saddled with a cost of three.5% or higher.

We’re talking a month-to-month charge of $1,265 for a 3% fee of curiosity versus $1,347, which is a distinction of $82 a month.

Within the current day, we is probably talking just a few 6.5% cost vs. a 7% cost, respectively, or roughly $1,896 vs. $1,996.

Not solely are you overpaying far more presently, nevertheless doing so might make the mortgage unaffordable given how extreme costs and residential prices are.

Why Do Mortgage Costs Vary by Lender?

Now as to why there’s value dispersion inside the first place, the CFPB components out plenty of completely totally different causes.

For one, not all lenders are created equal. Some have retail branches, whereas others solely exist on-line. We’re talking a website online vs. brick-and-mortar office home.

By means of enterprise practices, some retain their loans on their books and/or the mortgage servicing, whereas others shortly promote them off and switch on to the following mortgage.

There’s moreover branding – these you’ve heard of might spend some big money on selling and value barely higher costs consequently.

Others would possibly maintain their charges of curiosity elevated to ration demand, aka limit features due to functionality. Or simply calibrate to their urge for meals.

It’s moreover doable that corporations that don’t impose lender overlays price further for the elevated menace.

Lastly, it’s merely a matter of debtors not shopping for spherical. The usual borrower solely speaks to a minimum of one lender and believes prices are the an identical regardless.

So costs aren’t primarily dictated by standard present and demand variables.

My assumption is it’s harder to match prices on a mortgage than it’s a toaster.

Due to this, many shoppers merely associate with the first lender they impart with and title it a day.

If You Don’t Retailer Your Mortgage, You Might Overpay for the Subsequent 30 Years

Now proper right here’s the kicker in relation to a home mortgage. Within the occasion you do wind up with a mortgage cost .50% higher than the rivals, it’ll hit your pockets month after month.

It’s not a one-time misstep like a TV purchase or a lodge room. You don’t merely pay extra one time and overlook about it.

That higher charge sticks with you for as long as you preserve your mortgage. If we’re talking just a few 30-year mounted dwelling mortgage, that would presumably be a while.

So the error of not shopping for your cost might price somewhat you $100 each month for as long as the mortgage is held.

For me, that’s masses worse than overpaying for a product one time.

Prolonged story fast, in case you occur to’re extreme about saving money, you’ve obtained to position shortly and talk to higher than just one lender.

An accurate dwelling mortgage search must embrace native banks, credit score rating unions, mortgage brokers, and on-line lenders. Don’t limit your self to just one type of agency.